The Broader Economy - NJ Housing Market - Bergen County Housing Market

The Broader Economy:

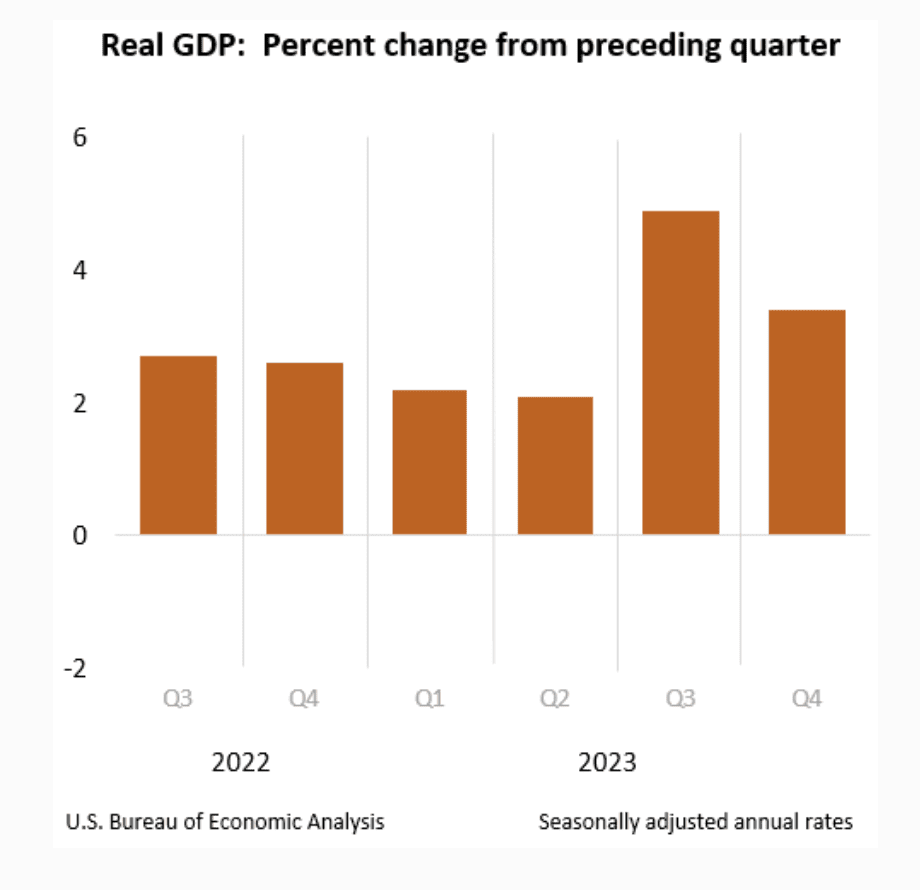

US Economic Growth, GDP, slowed in 2023 from an increase in Q3 of 4.9% to Q4 at 3.3%. The 3.3% was still a faster pace than expected. That left the US with an annual GDP of 2.5% in 2023.

The US Unemployment Rate just dropped to 3.8% in March, whereas the NJ Unemployment Rate stayed flat for the 6th consecutive month at 4.8%.

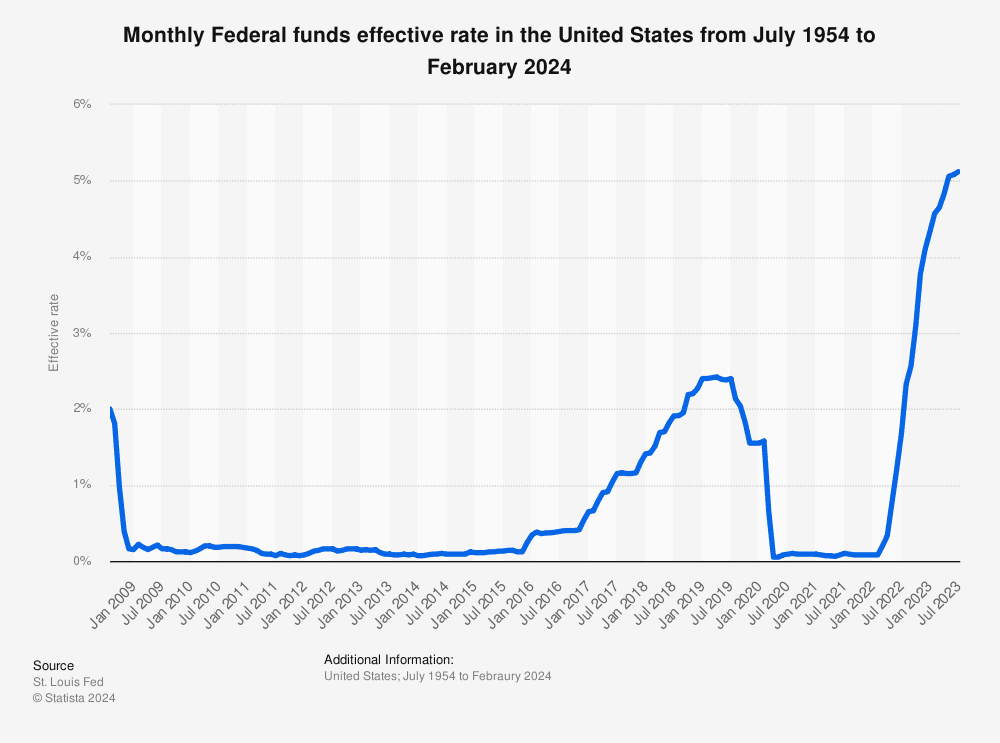

The U.S. Federal Funds Effective Rate still sits at 5.25 to 5.5 percent. It determines the interest rate paid by depository institutions, such as banks and credit unions, that lend reserve balances to other depository institutions overnight. Changing the effective rate in times of crisis is a common way to stimulate the economy. It is currently still high to reduce inflation. Policymakers have signaled that they will slash rates should inflation come down to their 2 percent target.

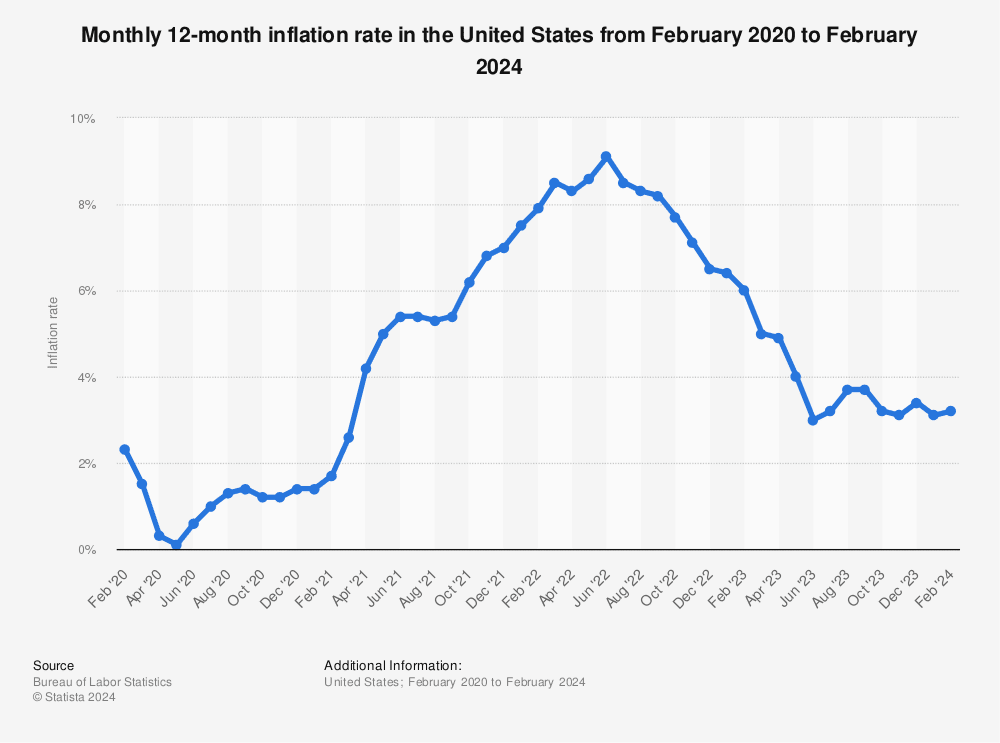

Monthly inflation is hovering around 3% since June of 2023 ranging from 3.1% to 3.7%, sitting today at 3.2%.

But an economy that may avoid a recession as inflation moderates without the Fed's tight monetary policy doing too much damage to the jobs market would help the housing sector.

"Stronger economic growth will benefit the housing market, keeping demand robust," Mike Fratantoni, MBA's chief economist, said in a statement shared with Newsweek.

A further reduction in inflation will enable the Federal Reserve to cut rates later this year—as they have been hinting.

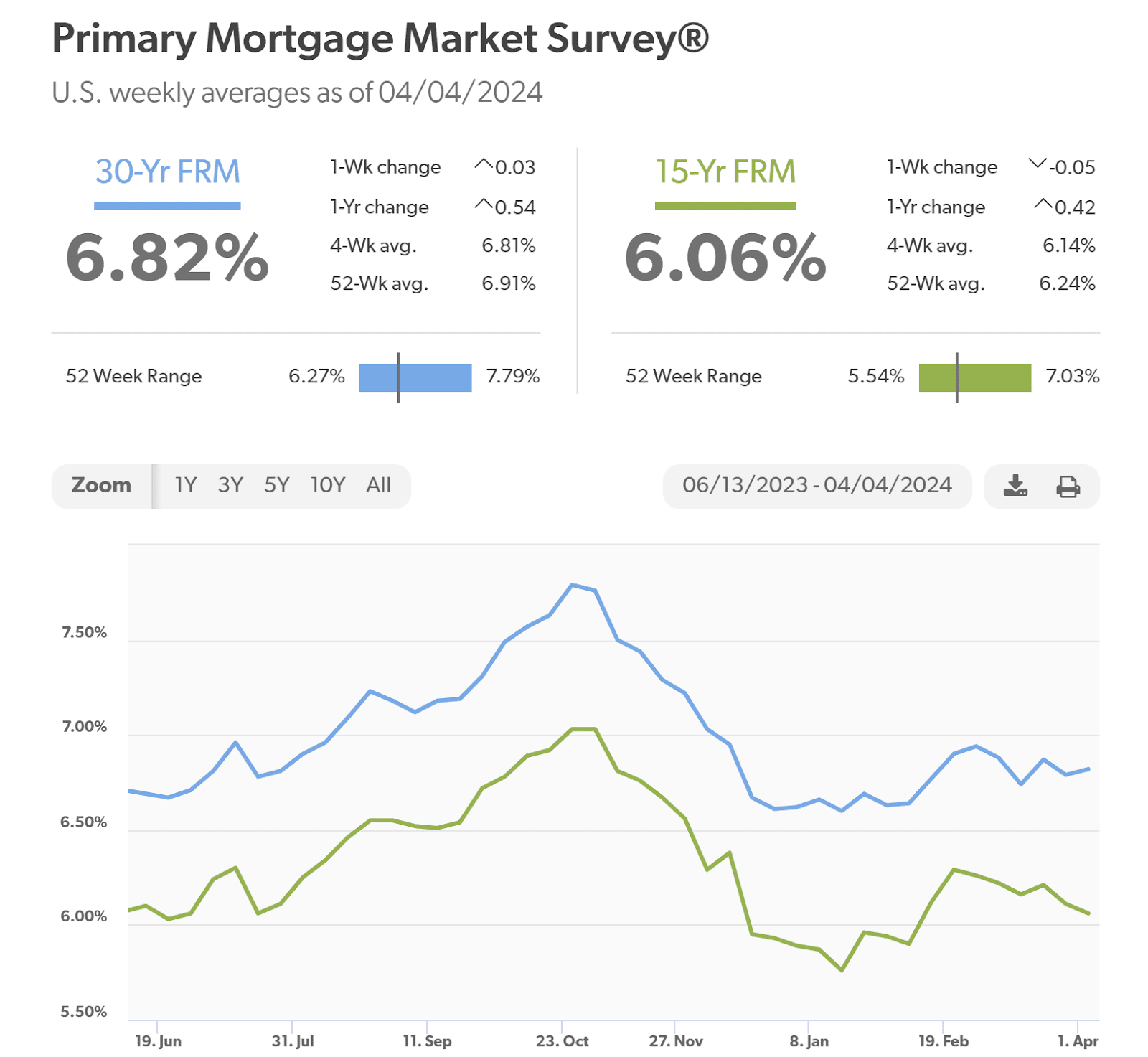

Mortgage rates have fallen for their recent October high of 7.79% to today around 6.82%. Rates have been pretty steady in 2024, hovering in the 6.6% and 6.8% range. These rates are still elevated because of the continuing strong performance of the national economy and inflation readings which continue to be well above the Federal Reserve Bank’s 2% target.

The NJ Housing Market:

The NJ Housing Market remains strong, fueled by the reduced inventory of 10% YOY since 2019. However, we do see a steady uptick in inventory since last December. “At the same time, more buyers who can afford mortgages entering the market will push up prices”, analysts from Goldman Sachs said.

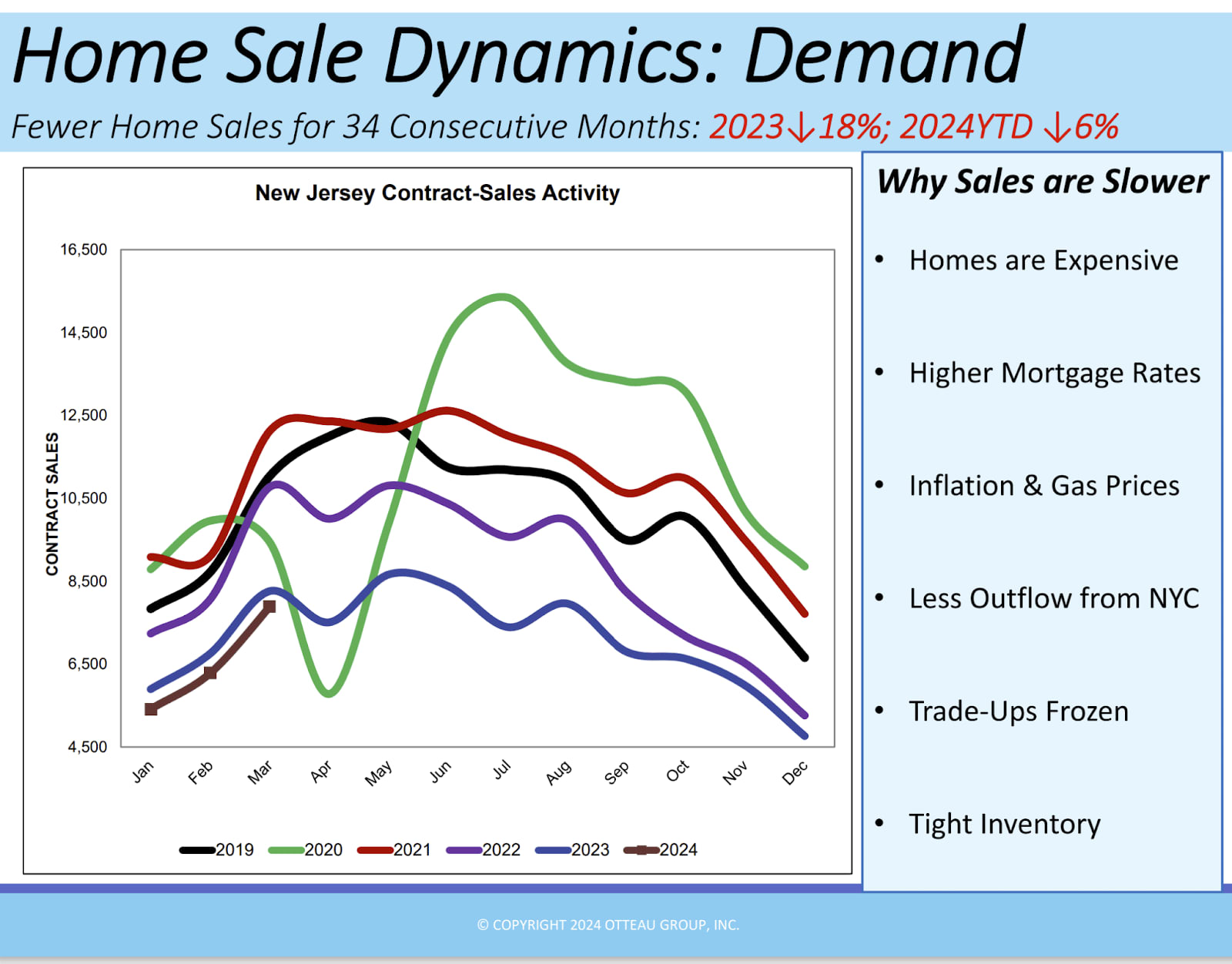

The year started a little softer with 6% less contracts written but … "Despite persistent inventory challenges, we anticipate a busier spring homebuying season than 2023, with home prices continuing to increase at a steady pace”, says Sam Khater, Freddie Mac's chief economist.

The real estate community experts project prices to continue to rise in 2024 at a slower pace than in the prior years. That is in part due to the still relatively high interest rates as well as the low inventory. Also buyers are starting to feel the pain and many experience buyer’s remorse during their transaction and cancel the contract. While the housing market is predicted to be strong, sellers may find that this year may be that last year with buyers tripping over each other and offering large amounts over the asking price.

Bergen County YoY Dynamics:

Since 2019 NJ is seeing an inventory decline of 10% YoY. Bergen County is expected to see 14% less inventory in 2024 compared to the prior year, resulting in continuing strong home sales.

Homes for sale - 26%

New Listings -1.3%

Sold Properties -2.4%

Days On Market -26%

Average. Sales Price +11%

The pace of home sales keeps slowing down, due to the fact that during the first two months we have 12% fewer houses under contract than last year.

What to expect in 2024:

Economy:

- economy appears to be slowing

- inflation likely to decline further

- lower interest rates by fall

Housing:

- More Inventory & Sales

- Home prices to increase only slowly

- Return to a more normal state in 2025 and 2026

Sellers: 2024 will be another strong year to buy, however, with more buyers having buyer’s remorse and the sales pace slowing down, this year may be a good time to sell.

Buyers: With rising home prices, even if the pace of sales may slow down, it is still a good and smart time to buy. “You marry the house and date the rate!” - Today you will pay less for a house and can refinance at a later point.